With increased enforcement efforts by tax authorities globally to ensure that multinational companies pay their fair share of taxes, transfer pricing and an adjustment to taxable income can be seen as an easy target, meaning tax authorities are more likely to challenge intercompany arrangements.

In line with global trends, transfer pricing has become an area of focus for Irish Revenue and can give rise to significant tax exposure.

Overview of transfer pricing in Ireland

Transfer pricing is essentially the pricing of transactions between connected companies, with the aim of the transactions being undertaken at an arm’s length or market price. Following Irish legislation and the OECD’s Transfer Pricing Guidelines, the prices agreed between related parties should be the same as those negotiated between independent parties acting at arm’s length.

While there are specific exemptions from Irish transfer pricing rules (SME exemption, certain domestic transactions), there are significant documentation requirements and penalties for non-compliance.

Irish transfer pricing provisions

Irish transfer pricing rules are in line with the OECD Transfer Pricing Guidelines.

Irish transfer pricing legislation has extended the scope such that the rules now apply to intercompany transactions (trading and non-trading) with associated documentation requirements.

Irish branches are also within the scope of Irish transfer pricing rules, with the Authorised OECD Approach (AOA) for the attribution of income to a branch applicable for periods commencing on or after 1 January 2022. The AOA seeks to attribute to a permanent establishment or branch the profits it would have earned at arm’s length if it were a separate company, i.e. the branch and the remainder of the company would be treated as distinct entities for tax purposes. Going forward, there is a set method to apply transfer pricing rules for the attribution of income to an Irish branch of a non-resident company.

Documentation requirements

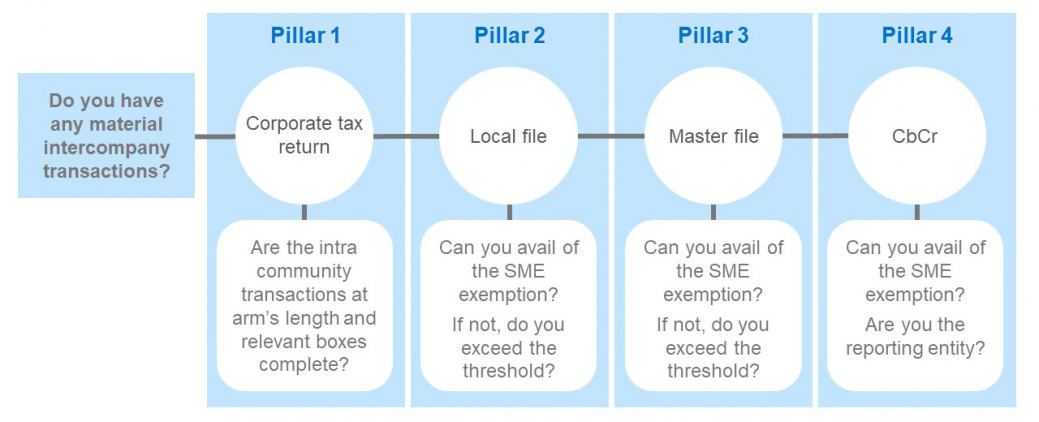

A four-pillared approach to Irish transfer pricing documentation obligations for multinational enterprises exists.

Local file: Required if annual group consolidated turnover > €50 million

The Local Transfer Pricing File focuses on local country operations and aims to analyse intra-group transactions of the local entity from the perspective of the arm’s length principle. This document should include all intercompany transactions relevant to the specific entity for whom the file is being prepared.

Master File: Required if annual group consolidated turnover > €250 million

The goal of the Master Transfer Pricing File is to provide an overview of the global operations, business strategy, value creation processes, transfer pricing policy, and taxation status of the whole corporate group.

CbCR: Required if annual group consolidated revenues > €750 million

The purpose of the Country by Country Report (“CbCR”) is to provide all competent tax authorities with an overall picture of the whole multinational group, expressed in numbers across all tax jurisdictions, such as related and unrelated party revenues, profit or loss before income tax, income tax paid, number of employees, etc. The associated Irish CbC reporting obligations include:

- CbC Report – For an Irish resident ultimate (or surrogate) parent entity of an MNE Group.

- CbC Notification – For an Irish resident constituent entity of an MNE Group.

Deadlines & penalties

Documentation type | Deadline | Penalty for non-preparation |

Local file | In place by the corporation tax return filing deadline for the relevant period*. | €25,000 plus €100 for each day the failure continues. |

Master file | In place by the corporation tax return filing deadline for the relevant period*. | €25,000 plus €100 for each day the failure continues. |

CbC report | 12 months after the end of the accounting period. | €19,045 plus €2,535 for each day the failure continues. |

* While the TP files are not submitted with the corporation tax return, Revenue can issue a written request for the transfer pricing documentation to be provided to them within 30 days.

Please note where taxpayers do not breach the thresholds to require a Master File and/or Local File, a fixed penalty of €4,000 will apply for failure to provide records supporting the arm’s length rate(s) applied within 30 days of a request from Revenue.

Exemptions

Small & Medium Enterprise (SME) exemption

There is an exemption from Irish Transfer pricing rules, such that the rules do not apply to computing the profits, gains, or losses of Small & Medium Sized Entities (SMEs). Broadly, this comprises groups of companies where the consolidated group:

- Employs < 250 employees, and

- Either has:

- Turnover of < €50 million

or

As the above thresholds for inclusion apply globally, a small local subsidiary of an international group can fall within the scope and require supporting documentation.

It should also be noted that legislation provides a provision to bring SMEs within the scope of Irish transfer pricing rules with reduced documentation requirements (depending on size). However, this is subject to Ministerial order and has yet to commence. Only when such time will SMEs fall out of the scope of the Irish transfer pricing rules.

Domestic exemption

Basic Irish transfer pricing rules are disapplied for certain non-trading domestic (Irish to Irish) related party transactions.

The following conditions must be met by the supplier (lender) and acquirer (borrower) of the transaction for the exclusion to apply:

- The supplier and acquirer must be chargeable to income tax or corporation tax under Schedule D (other than trading income under Case I or II in the case of a supplier) regarding the profits, gains or losses arising from the arrangement under consideration.

- Both the supplier and acquirer must be residents of the State for income tax purposes for the relevant chargeable period.

- The supplier and acquirer must not be a qualifying securitisation company within the meaning of s110 TCA 1997.

There are also anti-avoidance provisions which require consideration in respect of this exemption.

How can Mazars help you?

Mazars have a specialist transfer pricing team with local and international experience and expertise. The transfer pricing team at Mazars can assist with your specific needs.

Mazars offers the following transfer pricing-related services:

Planning and advisory services

- Identification of transfer pricing risks.

- Transfer pricing advisory services.

- Transfer pricing year-end adjustments.

- Establishing transfer pricing policies.

- Preparation and review of inter-company agreements.

- Advance Pricing Agreement (“APA”) submissions.

- Collaboration in Mutual Agreement Procedures (“MAP”).

Documentation review and preparation

- CbCR notification and reporting both on an intra-group level and to tax authorities.

- Preparation and review of transfer pricing master file.

- Preparation and review of transfer pricing local file.

- Preparation of benchmarking analyses.

- Preparation of transfer pricing disclosure.

Assistance in tax audits

- Representation in the course of tax authority investigations.

- Assistance in the preparation of appeals, observations and negotiations with the tax authority.

If you have any questions about the above, or if you would like to discuss this topic further, please get in touch with a member of the Mazars corporate tax team.