Pre-emptive Recovery Plans are unique to each company and are generally highly sensitive and confidential. At the same time, insurers are keen to benchmark their approach with that of their peers. To facilitate and support insurers in this area, we ran a survey during the summer of 2022 covering a broad range of aspects of the requirements.

Our report provides insight into

- Key areas of challenge and areas for future improvement

- Recovery Plan report style

- Ownership & Governance of Recovery Plans

- Recovery Indicators & Options

- Integration with ORSA & the Risk Management framework

- Scenario Analysis

- Communication Plans.

A sample of our findings:

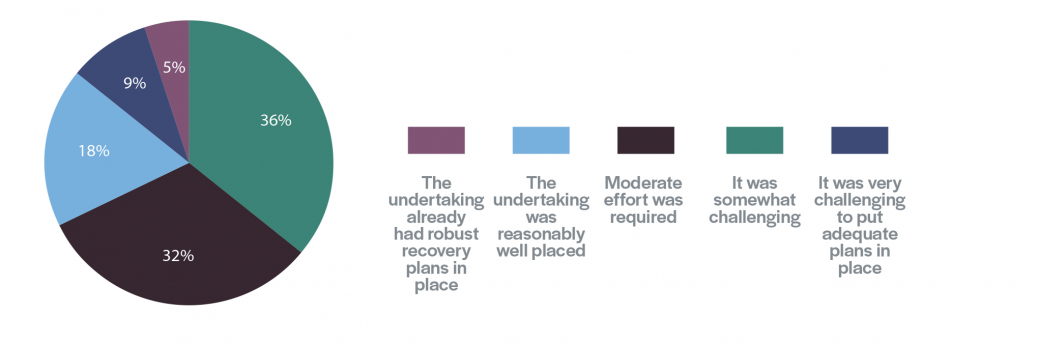

To what extent have the new regulations been a burden on the undertaking?

Results indicate that (re)insurers have coped well with the new regulations, though a small proportion found them very challenging.

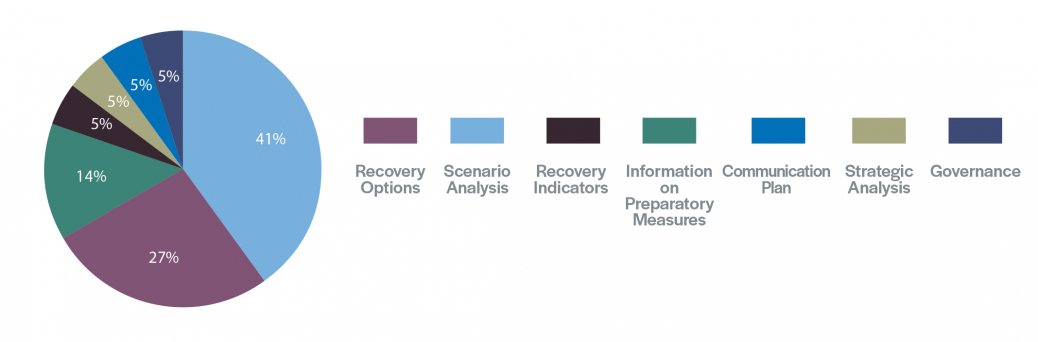

What section of the Recovery Plans proved to be the most challenging for the undertaking?

Scenario Analysis was the area that proved to be most challenging for insurers, followed by Recovery Options.

Two key areas for future improvement/development are:

- Increasing the sophistication of approach to recovery indicators, and

- Communication plans, which contain internal and external aspects.

For assistance in developing your recovery plans, please get in touch.

Join our mailing list

Looking for actionable insights? Thoughtful solutions? Bite-sized advice you can put to work, right now? Get the latest tips in your inbox. Subscribe